A personal line of credit financing are a method of financing in which a borrower is entitled to receive and employ the funds inside an allotted time, which have an excellent disbursement limit and you can/otherwise a personal debt restriction. The financing range agreement includes a duty of one’s lender in order to render financing to the installment loans Eagle debtor contained in this a specific period of day significantly less than agreed small print.

A borrower is get-off specific tangible assets (like a car or truck otherwise a home) due to the fact defense for a loan, which in turn gets a guaranteed debt on the collector which affairs the borrowed funds. For this reason, the borrowed funds are safeguarded, and when the brand new debtor non-payments, the new creditor requires fingers of resource made use of as the safety.

Have a look at financing can be used to refer to pay day loan one to is actually granted to own a brief to a borrower by the look at. To discovered cash otherwise transfer loans on their coupons membership, individuals need produce a seek out the full number of the new financing, including create even more costs and you will fees to it. In lieu of a, sometimes, loan providers merely access the fresh new borrower`s savings account where then they take the place amount.

not, there are even alive look at funds. You can found such that loan render from the email address off some banking institutions otherwise creditors. Usually, the fresh new have a look at loans the financial also provides was characterized by bad fee words and you can a top yearly rate of interest.

The provided take a look at serves as a hope away from payment of your cash advance amount in a timely fashion. Until then, its left because of the financial. Pursuing the termination of pre-built commission months with regards to the examine, the brand new borrower sometimes will pay extent also even more fees and you may need for cash and/or amount try taken from their offers membership.

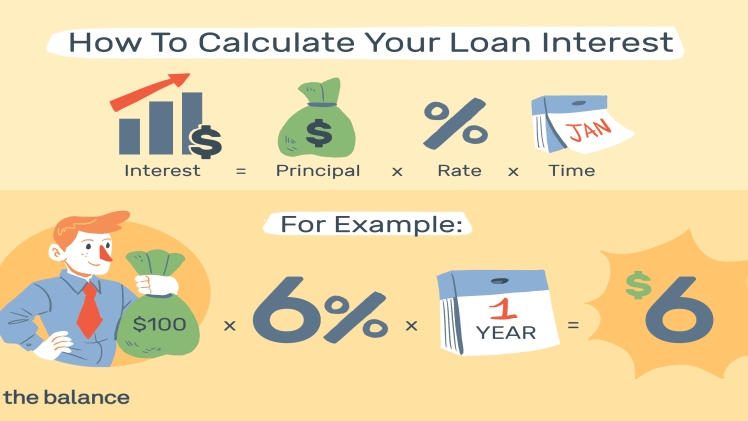

The minimum mortgage amounts variety with regards to the specific financial and you may the state. The typical minimum number was a hundred bucks. Additionally, you might always wake-up so you can a thousand cash.

Such signature loans are very well-known certainly one of individuals having a low credit score and bad credit record. Payday loans usually are very easy to get since the majority of loan providers dont think about the personal debt-to-money ratio.

A credit check which is open to you by a lender isn’t the best bet which exist. Thus, we advice cooperating with our company to find the top borrowing choice.

- Mortgage label lengths consist of thirty six so you can 60 weeks. Ergo, a monthly payment is quite brief;

- It is easy to get credit recognition as you have so you can render merely restricted individual or economic information. Borrowing from the bank commitment, research regarding the credit report, and credit rating usually are maybe not taken into account;

- New origination percentage range much. When selecting wisely, you might get loan continues in full rather than overpaying;

- You could pay back the loan number easily. It can positively affect your credit rating;

- By getting a check loan, you’ll save currency in order to combine a preexisting obligations;

- Payday loan are generally unsecured loans which means that youre not required to include one thing because the security.

Downsides away from Take a look at Funds

The main drawback off an unsecured loan was unfavorable loan commission terms and conditions like high-rates of interest. For this reason, you will need to repay more than simply all of the monthly money. Like, Apr range off 390 so you’re able to 780% for two-month fund.

App Techniques

All you have to do in order to score that loan is to submit a credit card applicatoin on line. You don’t need add even more files and supply data about your credit history. Additionally, the mortgage contract only get minutes. Therefore, bringing an unsecured loan online is an effective borrowing from the bank provider.

An enthusiastic unsecure mortgage was that loan arrangement that doesn’t were people guarantee for the latest borrower, against that the bank gives brand new requested money. Large loans and you may mortgage loans try scarcely offered instead guarantee, and that is often possessions (moveable otherwise immovable) or the borrower’s property.